Whether you are living paycheck to pay cheque, or you just like a little bit extra in your life, having a side project to make a birra money from is a great thing to do.

Great, but it can be difficult.

You won't be able to just pick up a hobby and instantly make cash from it. You'll will need to work out time management, demands, connections, and have a whole lotta ambition.

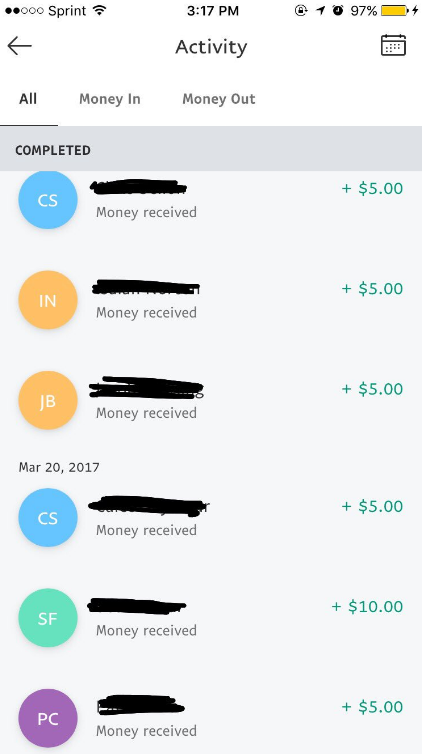

That said, it's not unattainable. If you feel like a little bit of side hustle could help you make rent each month, or buy you a few Topshop goodies, here are tips on how to make money out of a hobby:

1. DIY

Right, so you've just finished your degree and can't seem to find a job that fits in perfectly with what you want to do in your life.

This can be a tricky time because you have options, but you just don't know what one to choose.

Samantha Matt told The Financial Diet that this is how she began making her side hobby into work, which now brings in 50 per cent of her total income.

She wanted to be a TV writer, but couldn't find a job in that field. So, she found a position that was related to her degree, and then blogged on the side.

Blogs can be a bit saturated right now, but if you have an idea that is totally outside of the box, go with it and see if you can monetise it in the future.

However, if tech is not your thing and your hobby is more on the creative side, there are still endless possibilities.

For example, Kelly Ging of Kelly Lou Cakes began baking cakes at home and sold them out of her parent's hardware store in Co. Laois. She grew her business into selling a few on the side, to 100 a week and now hundreds upon hundreds every month.

So, plan how your hobby can make you some extra cash, see if there is a demand for it, work on it in your spare time, and then reap in the rewards.

2. Time management

This will come in handy in every aspect of your life.

If you're serious about making some money out of a side project, unfortunately it can't just be a bit of work here and there. You need a routine and you need to stick to it.

If that means taking two hours out each evening to concentrate on it, then so be it. Nobody said it was going to be easy.

However, if you have your time management down to a T, and stick to it, everything will be easier.

You won't burn yourself out and you will still have time to see your friends and family.

It's so important to stick to your set times, because if you put aside two hours for side hustle, but end up doing four, you'll no doubt end up grumpy and frustrated at the end of the night.

Discipline yourself, but be strict when it comes to your time off, too. As Jax Jones says, "Time is money so don't f*ck with mine."

Don't f*ck with your time, ladies.

3. Make connections

Whether you work in finance and your side hustle is painting or you have a job in content creation and your side hustle is making jewellery, you can never have too many connections in BOTH fields.

Even if your chosen industries are world's apart, you are bound to have people that work in both or that can help you out in one or the other.

Meet as many people as you can that could help your business – make connections through emails, Facebook, Twitter, Instagram and LinkedIn.

Between writers, bloggers, accountants, PRs, and marketing professionals, everyone is important.

But, you'll need to be brave. Go to events, introduce yourself, make your name (and side hustle) known and be polite to everyone.

Roisin Hogan went from being an accountant to creating her own healthy food business, Hiro by Roisin. She knew what connections meant in the industry when she started out and she took every opinion on board.

It just shows that your chosen side hustle doesn't have to be in line to what your job is now. And by making these connections in every field, you'll get your new venture out there.

The more people talk about it, the more they'll know about it and the more they'll want it.

4. It's not everything

Your work is not your life, and your side hustle is not your life, either. If you feel like your burning yourself out, take a step back and relax.

You also need to remember that if your side hustle doesn't work out, it's not the end of the world.

Even if you really want that little bit of wiggle room at the end of each month, working non-stop is not healthy, and you could end up hating your hobby.

Ambition leads to big things and you deserve to do what makes you happy, but remember that you do have options.

If you feel like you're stuck in a rut, or in a financial black hole, there are ways out. Talk to family, friends, your connections (they're really important) and see what you can do.

Your money-making hobby is supposed to be fun and it's supposed to take a bit of pressure off you – so don't let it do the opposite.

But as with anything in life, explore your options, find your strengths, and take time to work out what makes you happy.

As sappy as it sounds, you'll never know what a side hobby could lead to, or what you could learn about yourself from it.

Oh, and while we have you; don't forget to have your say in the inaugural SHEmazing Awards this May! It's time to vote, and you can do it right here!