Finance for 20-something women usually means not checking your bank account because you're too afraid to see the figure staring back at you.

We all know it's bad and that we should really keep on top of our money – but it's hard.

Your 20s are supposed to be a time of freedom, and sometimes that freedom means buying the latest Topshop vinyl trousers and having brunch every Sunday morning.

But, there are times when we need to save and budget our money. So, whether it's saving for a holiday, renting your first home, or working out what the hell an overdraft is, we're going to be here to help you along the way.

We're kicking off our new finance series with basics steps on how to save and budget your money each month:

1. You need to actually have a budget

This may all seem pretty simplistic, but it's where most 20-somethings go wrong. Know how much you make (whether it's weekly or monthly), figure out what you spend your money on and then find out how much is left over.

Stick to your budget each and every month without fail.

When you're aware of your spending habits, you'll be more able to control your money so you won't be wondering where that €300 went at the end of the month.

There are loads of online tools to help you, too. Check this out if you're planning your first budget.

2. Understand that saving money early is important

You need to save for your future. Whether you want to travel, buy a house, move country, or build a business – you need to save for it.

Most people in their 20s think that the future is so far away, but that means you have the advantage of time.

After you budget, learn how to enjoy life at a lower cost and appreciate that you'll be prepared for anything you want to take on in the future.

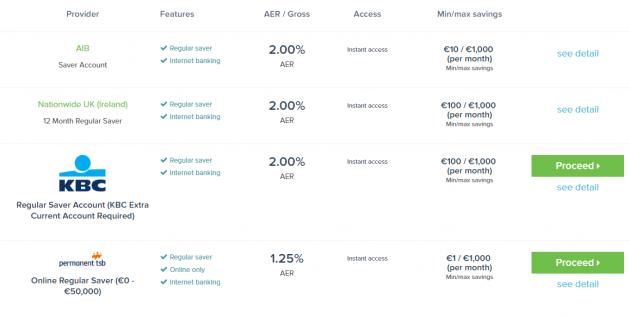

Visit Bonkers.ie to check out which bank will best suit you and what you want in terms of saving money. It's really easy to navigate and breaks everything down for you, too!

3. Prioritise

This is probably the hardest thing to do in terms of budgeting and saving money.

Because we ALL know that after a busy week at work all you want to do is reward yourself with a Penneys' shopping spree.

But have you paid your bills yet? Have you put some moola into your savings account? Did you do a food shop and will you have enough petrol to last until next week? These things ALL need to come before treating yo'self.

And as you hold off on buying things, you'll actually realise that you didn't need them to begin with.

4. Don't let payday pass by

Yep, your money just went into your account and now we're telling you to take it all back out again. We didn't say it would be easy.

But, if your rent is due in the middle/end of the month, it's easier to set up a standing order or direct debit to transfer money on the day you get paid. That way, you won't be tempted to dip into it during the month.

"The easiest way to save is to get used to not having it in the first place," says Petrina Grady, a savings and investment specialist.

5. Stop wasting everything

Even if you might think you're good with the whole waste and recycling thing – save everything and waste nothing.

Get the most out of what you buy each month, whether it's lunch you can eat the next day or using less toothpaste, every little counts.

And if you have a pile of old clothes or homeware bits and pieces lying around the house, sell them on Ebay or Depop. Not everything has to be binned.

These five tips are the basics of saving and budgeting. In this series we will delve deeper into finance for 20-somethings, but for now, sticking to these steps is a good way to start off.