I did the No Spending Challenge for a whole month, and I saved €800

My torturous four weeks of not spending any money are finally drawing to a close, and frankly, I couldn't be more delighted.

Having free reign over my financial choices has always been something I've taken for granted, frittering away my wages on exorbitant rental prices, ordering in, and glasses of gin that are much too fancy for the likes of myself.

Embarking on the 30 Day No Spending Challenge was definitely no walk in the park (though I took many of those, seeing as it's free), but I definitely learned quite a bit about my personal spending habits during my fiscal fast.

For those who don't know, the 30 Day No Spending Challenge focuses on benefiting your bank balance through a tight budget for four weeks.

Most adventurers into this monetary management challenge stick to a budget of about €50.00 a week, to spend on groceries, transport and socialising.

The challenge omits things like rent and utilities, as it is all about making the most of your disposable income rather than getting you evicted.

No spending for a whole month challenge starts now!

— alia (@nthldlcrz) March 2, 2017

The most difficult part was willing myself not to give in to my random splurges.

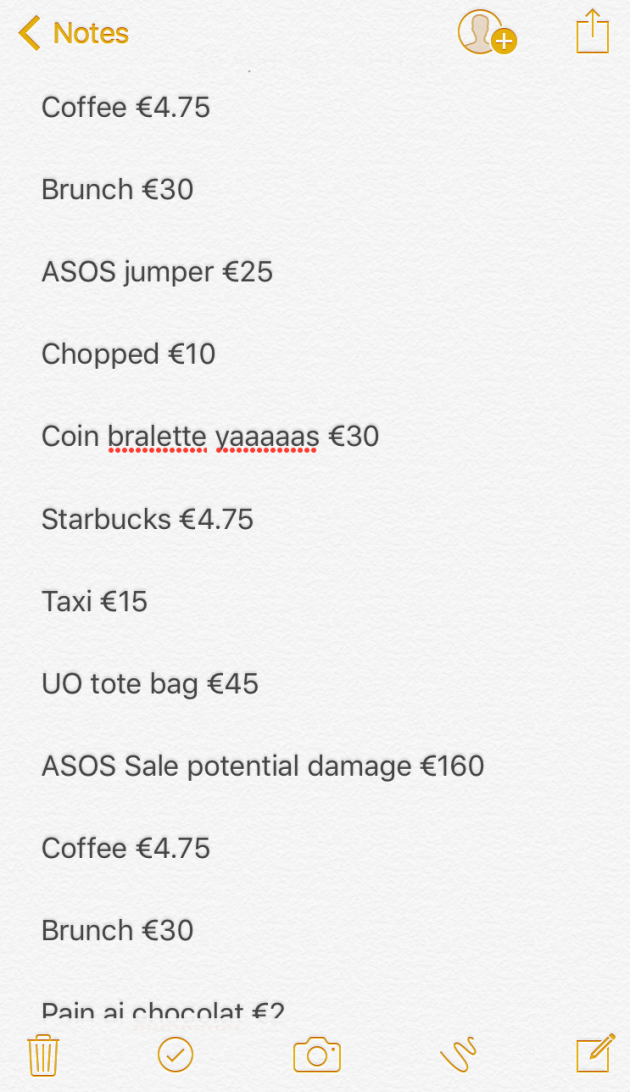

Seriously, the list of things I didn't buy this month because I was embarking on the challenge includes a gold coin festival bra, a faux Gucci belt (I was looking at too many bloggers' Instagrams that week) at least eight takeaways, a series of ASOS items and a selection of cacti.

As someone who takes Carrie Bradshaw's famous quote about liking to see her money hanging in her closet quite seriously, not purchasing clothes for an entire month was actually a lot harder than I thought it would be, but hey, the gold coin bra is still available so once pay day rolls around, it's mine.

Not caving to my food cravings was also pretty hard, and I'm not going to lie, there was an occasion where I did order in, completely blowing my weekly food budget on one delicious but ultimately unworthy meal.

The most valuable part of the whole venture wasn't the money I saved (though we will get on to that later) but the realisation and clarity that the challenge gave me when assessing where my money would have been going.

I kept a record of the things I didn't buy, a hangover from my oh-so frugal life as a student when I used to jot down all my expenses in an Excel sheet on my laptop, and I saved around €400.00 just by not giving in to my random coffee cravings and willing myself away from the computer screen during the ASOS sale.

To anyone considering taking on the challenge, I strongly recommend keeping track of everything you do spend and everything you don't spend on the way.

If opportunities come your way that you know are out of budget, jot them down to give yourself a better idea of how much you are saving per day or week as you go along to help keep you motivated.

My only other tips are to get used to public transport and make budget supermarkets your second home, but for a lot of people, those are very normal aspects of their lives anyway, myself included.

The trick here was to plan your journeys to be as cost efficient as possible, and also prepare your meal plans in advance so there is no opportunity to get side tracked at the supermarket.

Honestly, one day I had an intense longing for a pain au chocolat, and had intense separation anxiety from the bakery section after my trip, and that was because I hadn't quite prepared well enough for my grocery shop.

Avoiding the junk food and bakery aisles like the plague is a must.

As soon as I finish this final week of no spending, I'm buying enough pain au chocolats to block out the memory of my pastry-free month.

So, the big question, how much did I save and what am I going to to do with my freshly stashed dosh?

Well, if you must know, I saved €800.00 over the course of the month, most of which I'm going to put straight back into my student loan and get three or four months ahead in those loan repayments.

The rest is going on a good hair cut, a trip to my eyebrow technician, a packet of pastries and an absolute vat of gin.

Was it worth it? Absolutely.

Would I do it again? Well, as a means of saving for something big like a rental deposit or a holiday, this challenge is ideal, so I'd never say never to undertaking another fiscal fast in the future.